The European power market reached a historic milestone on the 30th of September 2025. After decades, the continent’s day-ahead auction switched from hourly to quarter-hourly trading. What might appear as a technical upgrade is a necessity to match the realities of a grid increasingly defined by intermittent renewables and electrified demand. After the first week of trading, we at Centrica Energy conclude that with greater precision comes greater complexity.

From hourly to quarter-hourly trading: Why the change?

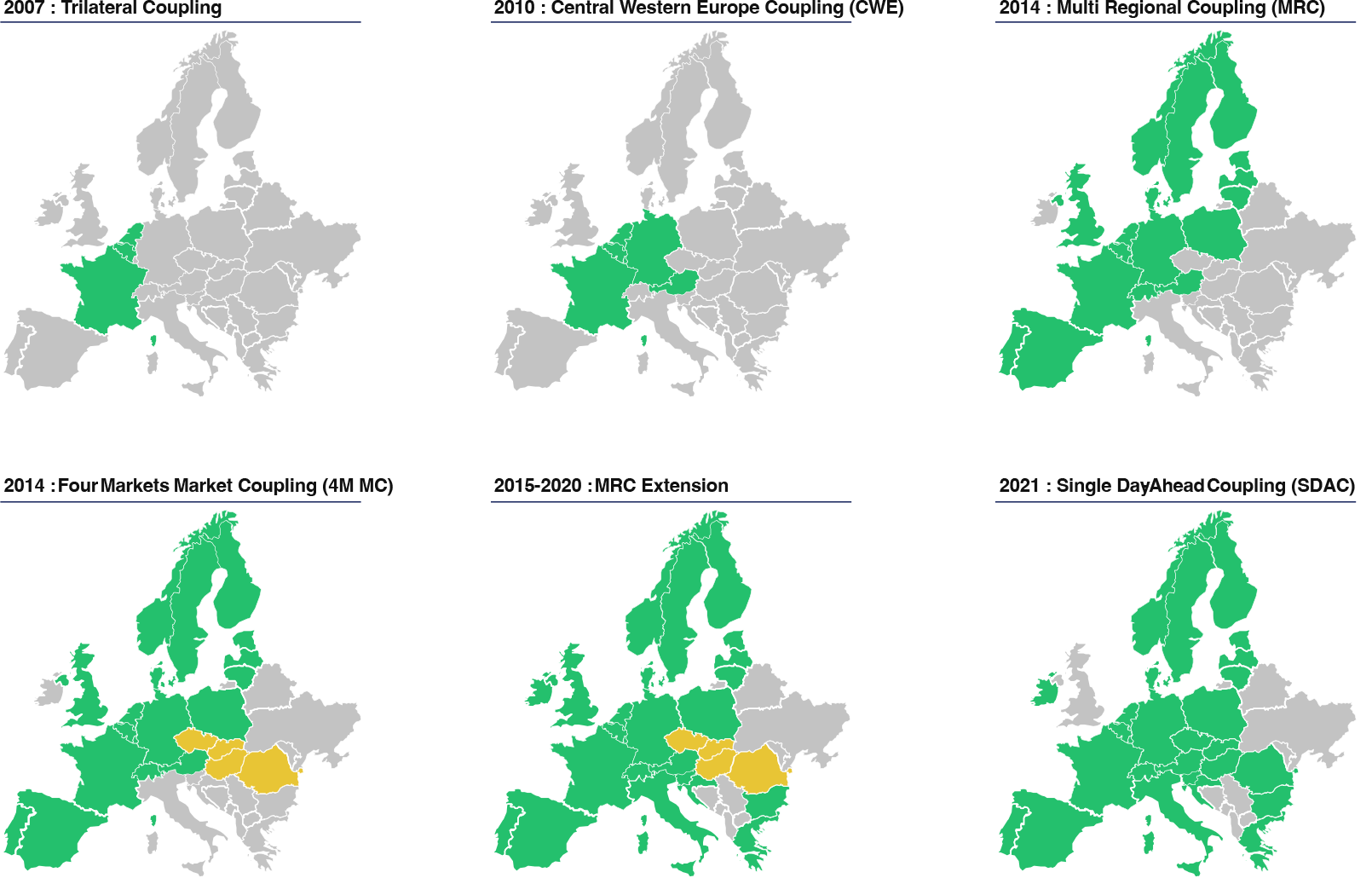

Europe’s day-ahead market is the world’s largest wholesale electricity market, trading over 1.800 TWh – that’s two-thirds of the continent’s power consumption. Since its inception in the 1990s, it has relied on hourly auctions to match supply and demand. Market coupling – where national markets progressively integrated into one pan-European auction – has been the backbone of the power system for the past decades, delivering an economic surplus of almost €12 billion per auction.

Yet hourly products no longer reflect how electricity is produced or consumed. Solar output can swing dramatically within an hour, and industrial consumers increasingly need flexibility to shift demand in response to price signals. The move to quarter-hourly trading aligns with the granularity already used in intraday and balancing markets, as well as with the time window in which market participants must balance their portfolios. This synchronisation was long overdue.

A rocky road to implementation

The transition was far from smooth. Originally planned for the 1st of January 2025, the go-live date was pushed back three times due to technical hurdles. The stakes were high: a failed launch, where markets decouple and countries revert to national pricing, can wreak havoc. In June 2024, a single decoupling event caused price divergences of over €500/MWh between countries, exposing companies to unhedgeable risks and disrupting futures markets. The memory of that chaos loomed large as the 30th of September 2025 came closer. Against this backdrop, the launch of quarter-hourly trading in 27 European countries was a success. But the real test began when the market opened.

What we saw during the first week: Sharper prices, sharper risks

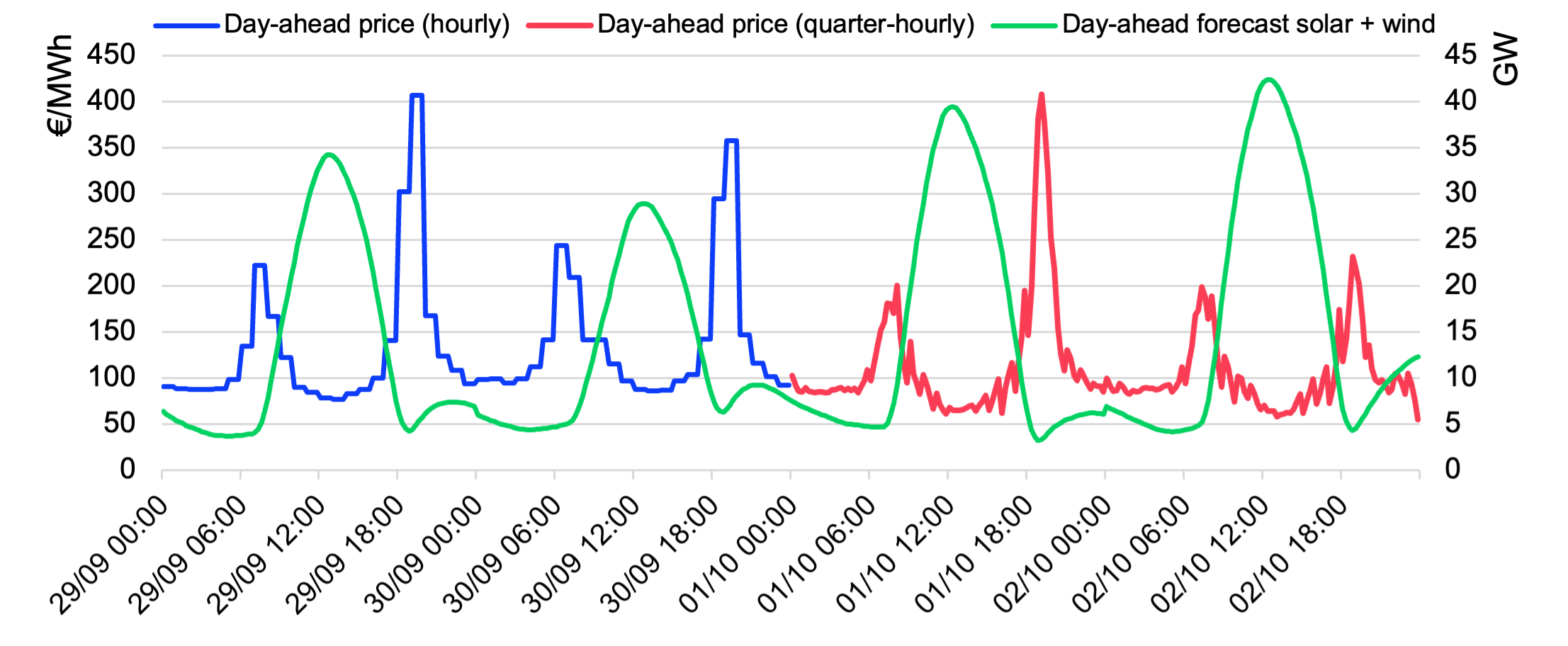

The first week of trading confirmed what we expected: volatility has shifted to Europe’s main power market. With 96 price points per day, the market reflects real-time supply and demand with far greater granularity. The smoothing effect of hourly averages is gone.

Morning and evening ramps – when solar output and demand shift rapidly – have seen particularly dynamic price movements. Traders know this “sawtooth” pattern, where prices rise during certain quarter-hours and drop during others. It first appeared when Germany introduced its local quarter-hourly auction in 2014, and again when the Intraday auctions launched in June 2024.

Now, price swings are visible in the day-ahead auction. The reason lies in the mismatch between flexible assets trading in shorter intervals, while inflexible ones still bid in hourly blocks. We expect this phenomenon to somewhat ease, as the market adapts and captures spreads.

Day-ahead volatility affects more stakeholders. It’s Europe’s biggest power market and traders started to move additional volumes from the first intraday auction to day-ahead. This means more exposure to sharper price signals for a number of downstream arrangements, including retail pricing, renewable support, and Power Purchase Agreements.

Winners and losers in the new market

The shift creates clear winners. Flexible consumers with smart meters and dynamic tariffs can now pinpoint the cheapest windows to run energy-intensive processes. A steel mill, for example, might shift production to a precise 45-minute slot when prices dip, rather than guessing within a broader hour. Similarly, battery storage operators can now leverage more frequent and steeper price spreads, charging when prices plummet and discharging during spikes. System operators may find balancing the grid easier, as finer granularity helps manage steep production ramps – Germany’s experience with 15-minute trading suggests balancing needs could decline. Furthermore, the switch could ease the frequency deviation phenomena observed during hour changes, when large assets perform significant steps in their production or consumption patterns. Trading entities with sophisticated algorithms can capitalise on micro-trends, while renewable generators may benefit from prices that better reflect their output patterns.

But the transition also brings challenges. Households without smart metering will see no immediate benefit – their bills will still reflect average prices. Smaller players, lacking the resources to upgrade bidding strategies or risk management, may struggle to keep pace. Data volumes have quadrupled, straining IT systems and demanding more precise forecasting. A minor scheduling error that once blended into an hourly average now carries a heavier cost. Smaller markets face liquidity fragmentation: with 96 products instead of 24, order books could thin out, making it harder to execute trades. Finally, block orders don’t align perfectly with quarter-hourly clearing. For participants needing to buy or sell in larger blocks, the new structure complicates matters, as they may face “paradoxical” rejections, leaving them exposed.

What comes next?

For now, the market is adapting. We at Centrica Energy, like others, have recalibrated our trading strategies, operations, and compliance frameworks to navigate the new landscape. But the success of this transition hinges on more than that. Market participants are calling for stronger fallback procedures to prevent decoupling chaos, greater transparency from power exchanges and system operators on capacity constraints and pricing data, and reforms to intraday markets. Extending cross-border trading windows by 30 minutes and shortening the pause of continuous trading during intraday auctions could further refine the system.

Overall, this shift signals a deeper transformation. Quarter-hourly trading isn’t just about finer price signals – it’s about building a market that can truly accommodate the intermittency of wind and solar. The volatility we see today may well be the growing challenge of a system learning to balance itself without fossil fuels. If managed well, this change will help to accelerate the green transition.